Most people people wait until they have a leak to get their roof inspected. But if your roof is 15 years or older, and you haven’t had it inspected recently, then you need to get it inspected this month. Here’s why:

A lot of insurance companies are reducing their roof coverage once your roof reaches the age of 15 years.

I’ve already had several calls this year from homeowners who are receiving these notices from their insurance company. When their renewal takes effect, their storm damage deductible is going up and/or they are losing half or more of their coverage on their roof.

All this to say, make sure you look at your renewal policy closely. If you’re losing significant coverage, then get a roof inspection scheduled asap. Even if your roof seems fine, and it’s not leaking, this may be your last opportunity to get insurance to pay for the majority of a new roof. This could be the difference between paying $1000-$2500 now or $10k-$15k for a new roof in a few years.

It may not be top of mind right now, but trust me, you’ll be glad you took action early. Home insurance is not cheap, and at Evergreen, we always try to help our customers get the most out of their policies, so they can protect their homes and save money.

The statute of limitations is about to run out for the March 3rd, 2023 wind storm in Kentucky.

The US Department of State specifies the following about filing insurance claims:

“The statutory limitation in which a claim may be presented is 2 calendar years. The time of accrual begins at the time of the incident causing the loss or damage or when the loss or damage was or should have been discovered by the claimant through exercise of due diligence.”

We are coming up on the 2 year anniversary of one of the most destructive, widespread wind storms Kentucky has ever seen. This storm occurred on March 3, 2023. I remember it well because we had to get our church’s roof replaced as a result of the damage.

I’ll tell you who also remembers this storm well - insurance companies in Kentucky - because they had to pay out millions of dollars on it.

Well, if you haven’t gotten in on the payout for this storm, then you only have a few weeks left to investigate and file a claim.

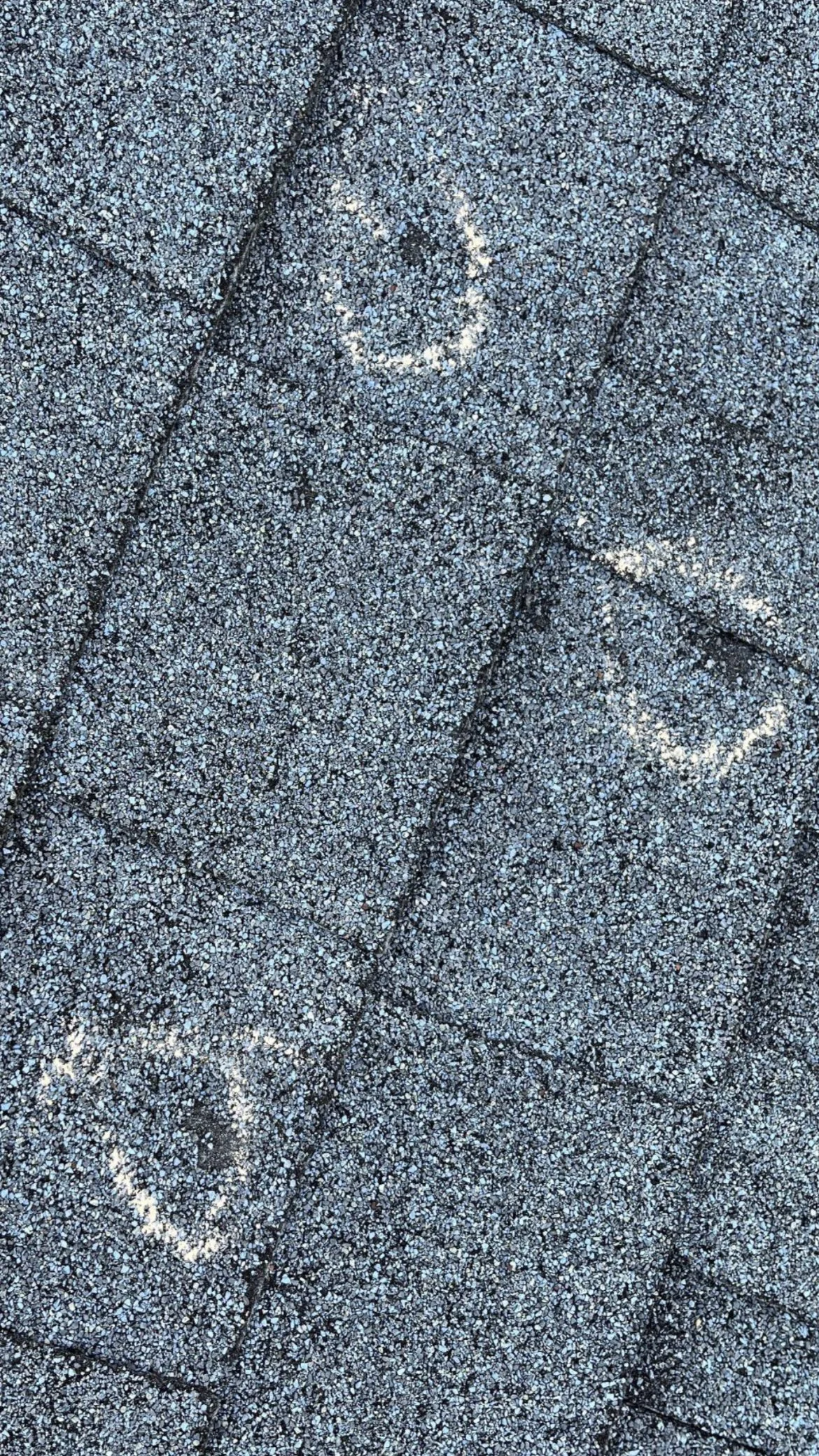

Ensure you’ve done your due diligence to investiagte wind damage on your roof. In most cases, you can see missing shingles from the ground, but you probably won’t be able to identify other wind damage like tearing or creasing without an inspection from a roofer who knows what to look for.

Schedule an Inspection

At Evergreen, we offer free inspections for storm damage, so there’s no financial risk in getting your roof looked at. If we don’t find damage, then you at least have the peace of mind of knowing you don’t need to file a claim. But if we do find damage, then you could be looking at saving thousands, even tens of thousands of dollars.